If you feel overwhelmed with the amount of information swirling around right now, you are not alone. Across the country, everyone’s inboxes are filling up with headlines, articles, and webinar invites about the Coronavirus, government shutdowns, and stimulus programs. In the last 30 days, we have seen more economic disruption and more government intervention than we have ever seen in the united states. And like everyone else, you’ve probably heard about some of the things the government is doing, but don’t know how to take advantage of them.

If you feel overwhelmed with the amount of information swirling around right now, you are not alone. Across the country, everyone’s inboxes are filling up with headlines, articles, and webinar invites about the Coronavirus, government shutdowns, and stimulus programs. In the last 30 days, we have seen more economic disruption and more government intervention than we have ever seen in the united states. And like everyone else, you’ve probably heard about some of the things the government is doing, but don’t know how to take advantage of them.

This will be the first of a series of articles summarizing everything so you can get what you need and get back to work.

Here is a summary to guide you through the first steps of applying for the stimulus loans and grants the government released last week. There are two programs (EIDL and PPP) that will send money your way, and here is how we’d recommend tackling them.

Economic Injury Disaster Loan

First and foremost, apply for the advance payment of EIDL (Economic Injury Disaster Loan) Program:

- It only takes 5 minutes to apply for an advance payment of the EIDL. Get started here - https://covid19relief.sba.gov/#/

- The EIDL program is designed to help you get the cash you need to keep working during the Coronavirus recession, and the advance is a $10K payment to your bank account within a week.

- A few days after you submit this application, someone from the SBA will contact you to request more information and documents to calculate the full loan amount and finish processing the paperwork. Outside of the PPP, this is the best loan you can get right now. It will allow you to defer payments for a year, spread the future payment up to 30 years, and will only charge a 3.75% interest rate. It’s important to know that this loan does not currently offer any forgiveness, does require collateral, and may require a personal guarantee. However, you can use this money for any business expenses that you otherwise would have a hard time paying for during the Coronavirus disruption.

- For more information on the EIDL, click here.

Paycheck Protection Loan

After submitting the application for EIDL, apply for the PPP (Paycheck Protection Loan):

- Go to your bank’s website and look for a link about Coronavirus or The Paycheck Protection Program. If you can’t find it, call your banker, or customer service to find it. If your bank isn’t currently offering it, you can still get it at a different bank. Here’s a list of banks that are participating: https://www.sba.gov/paycheckprotection/find

- Through the PPP program, the government is sending $349 billion to help you pay your payroll for 8 weeks, plus 25% for rent and utilities. And if you use the money for these expenses, they will forgive the loan and you won’t even have to pay it back.

- Once you get your hands on an application, fill it out accurately, gather the required information, and submit as soon as possible; it’s a lot of money, but it will go fast. Some banks are just asking for your name and phone number at this point and others are already accepting full applications, so this step will vary.

- A few days after you submit this application, someone from the bank will contact you to request more information and documents to calculate the full loan amount and finish processing the paperwork. Again, if you use the money correctly, you won’t have to pay this back. But even if you do decide to use the money for non-qualified expenses, this is the cheapest business loan you can get, with a 1% interest rate; and there is no personal guarantee nor collateral requirement, you can defer payments for 6 months, and can spread the repayments for 2 years.

- For the detailed fact sheet, click here.

At this point, you will have two pending loan applications. Here’s how to approach them.

- We recommend accepting the maximum amount of the PPP that is offered to you. We’ll get into the calculations in the next section, but because this is mostly forgivable and extremely cheap if you do have to pay part of it back.

- When the full EIDL is offered to you, you need to decide if you actually need the money, if taking on additional secured debt is right for your business’s situation, and if you will be able to pay it back. This can be a complicated question, but the loan is designed in your favor to help you purchase materials and pay your other bills during this recession. However, if you do get EIDL and would like to pay it off with the PPP loan, you can refinance it into the PPP.

__________________________________________________________________________

PPP Loan Calculations

(Downloadable Spreadsheet Template)

The PPP is an incredible resource for small businesses. With it, the government will pay 8 weeks of your payroll, plus 25% for rent and utilities. Here are how the calculations work:

Maximizing the PPP Loan Amount

- Qualifications

- You must have been in operation since February 15th, 2020

- You must have fewer than 500 employees (excluding franchises)

- If you own multiple businesses, they may be combined when calculating the loan

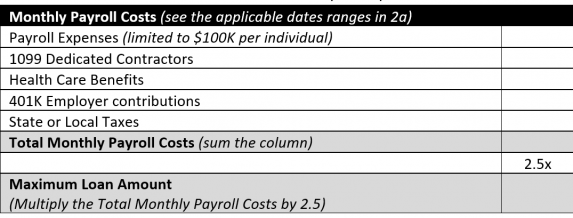

- Maximum Loan Amount

- Were you in business February 15, 2019 – June 30, 2019?

- If yes, the max loan equals 2.5x the average monthly payroll costs of the 12 months prior to your application.

- If no, the max loan equals 2.5x the average monthly payroll costs between January 1 and February 29, 2020.

- For this calculation, average payroll costs:

- Includes salaries, hourly wages, commissions, tips, or other income

- Includes payments for vacation, parental, family, medical, or sick leave

- Includes payments for dismissals or separations

- Includes group health care benefits, such as insurance premiums

- Includes retirement benefits, such as employer 401K contributions

- Includes 1099 contractors who work predominately for you

- Includes state or local payroll taxes

- Excludes employee/owner compensation in excess of $100,000

- Excludes employee/owner compensation that live outside the U.S.

- Excludes federal payroll taxes and federal and state income taxes

- Excludes the new sick and family leave that receives tax credits

- Here is a worksheet to calculate how much of a loan you may receive:(Downloadable Spreadsheet Template)

- Were you in business February 15, 2019 – June 30, 2019?

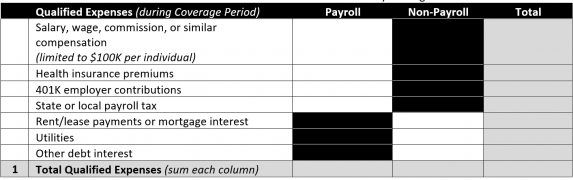

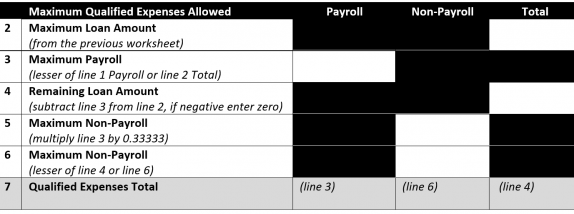

Minimizing How Much You Must Pay Back

- You will NOT have to pay back the portion of the loan used to pay Qualified Expenses during the Covered Period if you keep the same number of employees and you don’t reduce their pay by more than 25%.

- Covered Period = the 8 weeks immediately after the loan is issues

- Qualified Expenses include:

- Salaries, hourly wages, commissions, tips, or other income

- Limited to $3,846 per employee ($100,000 annualized)

- Group health insurance premiums

- Mortgage Interest (excluding principal payments and prepayments)

- Rent/lease payments

- Utilities

- Interest on debt that was incurred prior to the Eligibility Period

- Salaries, hourly wages, commissions, tips, or other income

- Create a folder to collect the following documentation:

- Employees on payroll with their pay rates

- IRS payroll tax filings

- State income tax, payroll tax, and unemployment insurance filings

- Receipts or bank records showing payment of Qualified Expenses during the Covered Period

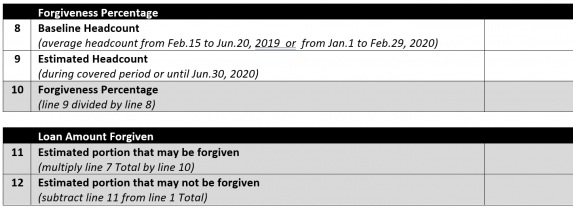

- Forgiveness Percentage = [Current] divided by [Baseline]

- Baseline = lower average headcount during either:

- February 15 to June 30, 2019

- January 1 to February 29, 2020

- Current = average headcount during the 8 weeks immediately after the loan is issued

- Excludes employees that make less than $100,000 with salary reductions of 25% or more, unless reinstated prior to June 30, 2020

- Includes employees rehired prior to June 30, 2020

- Here is a worksheet to calculate how much of the loan may be forgiven:(Downloadable Spreadsheet Template)

- Baseline = lower average headcount during either: